What VCs (now) like in Fintech: and Where, and Why

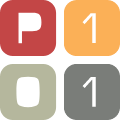

2022 could not be a good year for Fintech in Europe… but it could be worse. In fact, despite some big down rounds, such as Klarna’s, only few down or flat rounds have been counted to date:

What is next?

According to Morgan Stanley’s analysts, private markets usually suffer from public downturns 18 months later, on average, and therefore a trough in valuations is expected to show in July 2023.

Hence, private markets may have 10 further months of downturns or smaller funding rounds ahead, as VCs will become more selective, and founders won’t raise dilutive rounds.

On the other hand, there is a lot of dry powder (aka money) that must be somehow allocated especially by all the funds that have raised money in the last 10 months and that have decided to slow their investments down to see what turn the macroeconomic scenario will take. But if Morgan Stanley’s analysis is true, which is likely, these funds cannot wait 18 months and then start investing massively: they would not respect their investment period schedule (agreed with the LPs) since they would not have the time to make the necessary money deployment.

Where can VCs invest?

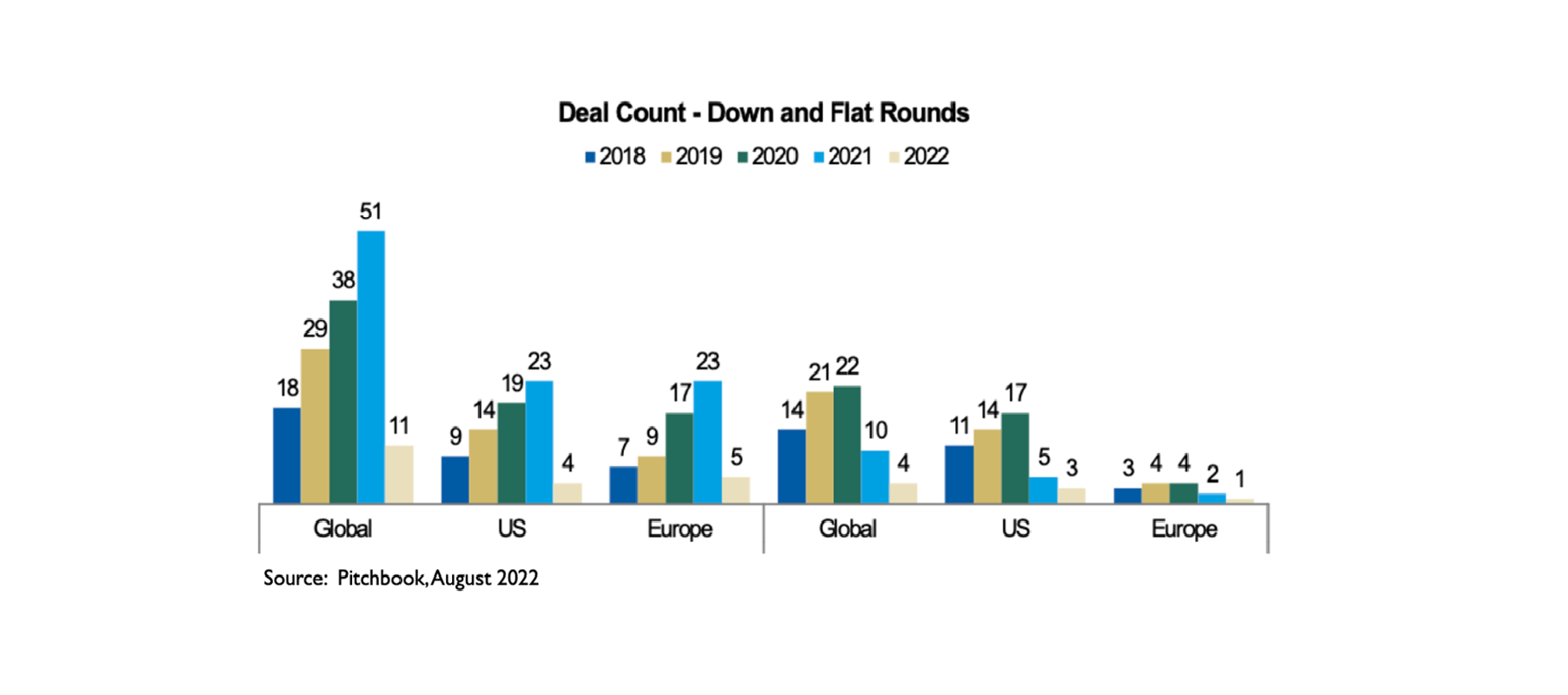

As a fund, we must understand and intercept future trends, analyzing fintech sectors that are currently overperforming the industry, despite all the macroeconomic scenarios:

SME Banking is the sector that has seen the most increase in funding in 2022, by far. Payments is still something hot as BNPL, but less than in 2021.

Why invest?

More and more SMEs are looking into embedded finance to decrease frictions with incumbent banks. According to a 2021 research by Accenture, based on a panel of more than 2,5k SMEs around the globe (especially Europe and the US):

- 41% of SMEs would be interested in using banking services from a digital service provider. A percentage that reaches 52% as businesses get larger (50-250 employees);

- 44% of SMEs prefer digital platforms to offer services in partnership with traditional banks. A number that falls to 30% as businesses get larger;

- 47% of SMEs would be willing to consider a premium price for embedded finance services. A portion that grows to 57% as businesses get larger.

It will be more and more fundamental for companies to get an extra revenue line (brokerage margin) by providing financial services to their supply chains, as if they were a bank. In this way they could increase margins and allow suppliers to be financed, for example, through plain lending or advance invoices, with interest rates that are currently just a few basis points above banking ones, helping them to overcome turmoils in a faster and simpler way.

For instance, among our portfolio companies is a leading embedded finance player, Opyn. This company is known for offering Banking as a Service (BaaS) products and supply chain finance. It gives SMEs a complete suite of tools from which they could both borrow money and also be lenders, according to their needs.

AI platforms and Saas business

Besides AI platforms that speed the credit process up and are super-interesting opportunities for SMEs, there are other fintech spaces for SMEs leading us into temptation, i.e., SaaS businesses:

- Risk management tools: so far there’s nothing for SMEs that could resemble a risk management function, as the one that all VC funds must have, with the result that lots of companies don’t know who they are working with, its financial stability, etc… with all the implications;

- Cybersecurity solutions that deal with fraud prevention & biometric access and protection;

- Tools for improving Financial Institutions’ KYC procedures.

Financial Institutions love SaaS and AI Fintech businesses because they have these features:

- Cost Savings: no hardware equipment updates, no installations or traditional licensing burden;

- No need for internal team: responsibility of the SaaS provider;

- Many value-added services: issuing and acquiring integrations have already been done;

- Regular updates: which will translate as a continuous stream of innovation to the members of the ecosystem;

- International profile: easy to deploy wherever its needed and in real-time, easy overcoming cross-border problems;

- Always on track with the newest technological trends;

- High and automated security controls;

- Agility to support volatile business cycles and demand patterns.

Both SMEs banking and Embedded Finance are trends that we believe will grow much stronger in the near future: fintech companies that will provide the technology to fill these gaps will probably be unicorns in a few years.